BC Property Assessments Released for 2026 Taxes

BC Assessment 2026: What Your Property Assessment Really Means

Each January, BC homeowners receive their updated property assessments from BC Assessment — and every year, the same questions come up.

Did my value go up? Will my taxes increase? Is this what my home is actually worth?

Here’s a clear breakdown of what the 2026 BC Assessment means, what it doesn’t mean, and what steps you can take if you have concerns.

When Are 2026 BC Assessments Released?

BC Assessment has officially released 2026 property assessments, which are now available online. Assessment notices are also mailed out, so homeowners should receive their physical copy shortly after the new year.

What Date Is Your 2026 Assessment Based On?

One of the most important — and most misunderstood — details is this:

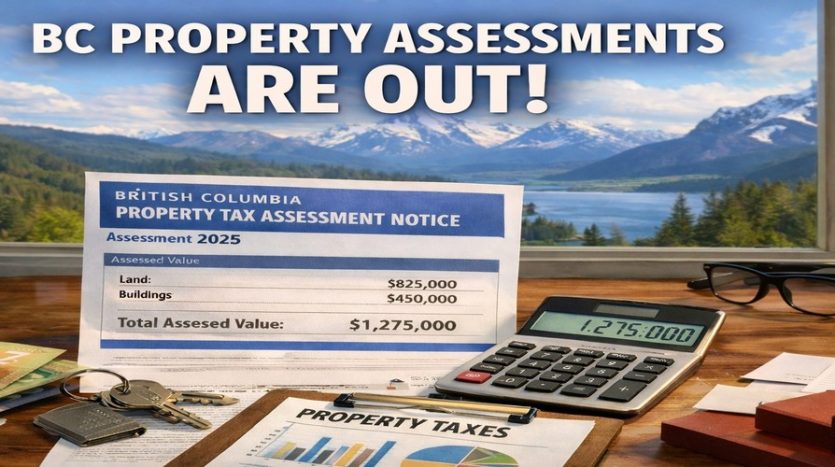

👉 Your 2026 BC Assessment is based on your property’s estimated value as of July 1, 2025.

This means the value shown on your assessment does not reflect today’s market conditions. Because real estate markets change over time, it’s very common for assessed values to differ from current market value.

Does BC Assessment Determine Your Property Taxes?

No — BC Assessment does not set your property taxes.

Instead, assessment values are used by municipal and provincial governments to determine each property owner’s share of the total tax burden.

This is why an increase in your assessment does not automatically mean your taxes will increase by the same amount. What really matters is how your property’s value changed relative to other properties in your municipality and within your property class.

For example:

-

If your home increased less than the municipal average, your tax increase may be smaller

-

If your home increased more than similar properties, your share of taxes could rise

Can You Appeal Your BC Assessment?

If you believe your assessment is inaccurate. You have the right to challenge it.

The deadline to file a Notice of Complaint (Assessment Appeal) is January 31, 2026.

It’s important to understand that an appeal should be based on factual issues or market evidence — not simply because the assessed value went up or down.

How to Check Your Property Assessment

You can search your property and review your assessment details directly on the BC Assessment website. A link is included on our website to make this easy – Click Here.

When reviewing your assessment, it’s helpful to compare:

-

Your assessed value to similar nearby properties

-

Lot size, square footage, and building age

-

Any features or upgrades that may differ

Need Help Understanding Your Assessment or Market Value?

If you have questions about your BC Assessment, want help reviewing comparable properties, or are curious about what your home would realistically sell for in today’s market, we’re happy to help.

Understanding the difference between assessed value and market value is especially important if you’re planning to sell, refinance, or simply want clarity as a homeowner.

📩 Reach out anytime — our contact details are available on the website.